Probabilistic commodity price projections for unbiased techno-economic analyses

New paper co-authored by Fanran Meng outlines a new method for projecting future commodity prices for techno-economic analyses without bias.

Creating a sustainable chemical industry requires the development of new processes that cheap enough to compete with the conventional fossil-derived production routes. To evaluate how economically feasible it is to roll out such new technologies at scale, stakeholders often use a Techno-Economic Analysis (TEA).

Product prices are the dominant variable affecting the outcome of a TEA. These prices are usually considered over a 20 to 25 year project life to calculate the cumulative Net Present Value (NPV). Long-term prices are selected by practitioners, and so these price projections are inevitably subjective to a degree. The robust, unbiased projection of representative, long-term prices are thus essential for investors, researchers, and policymakers who want to assess the economic feasibility of new technologies and processes.

There are a number of challenges to overcome when trying to source robust long-term price projections for techno-economic analyses, including uncertainty over the reliability of sources and their projections. Even when uncertainty and sensitivity analyses are conducted, there is always a level of subjectivity in the projections and their ranges of uncertainty.

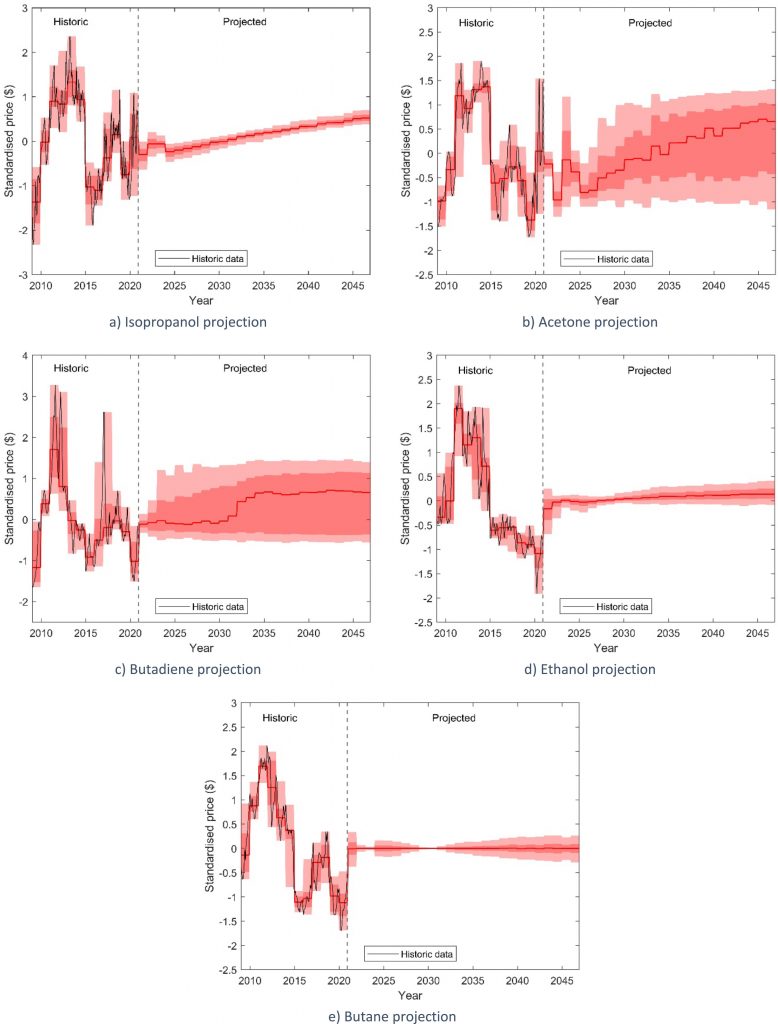

This article addresses the difficulty of forecasting the future price of products by using machine learning to produce unbiased probabilistic price projections for a range of chemical commodities 20-25 years in the future. The new approach uses an ensemble of 100 neural networks with Long Short-Term Memory layers which allow the model to learn from existing trends and produce a probability distribution of potential future prices. The projected prices are based on historical data on each commodity’s price and on the EIA’s projections of future crude oil prices.

The projections revealed variability in the price distributions of different chemical products. This suggests that, unlike in conventional TEAs, uncertainty ranges for future prices should be tailored to individual commodities, rather than using a one-size-fits-all approach.

For the rest of the key findings and more details on the methods, read the full paper here: Probabilistic commodity price projections for unbiased techno-economic analyses.

Photo credit: Nicholas Cappello